Bank of Canada Policymakers Expected to Hike Interest Rates Again

Economists Question Aggressive Rate Hike Approach

Ottawa, Canada - July 11, 2023

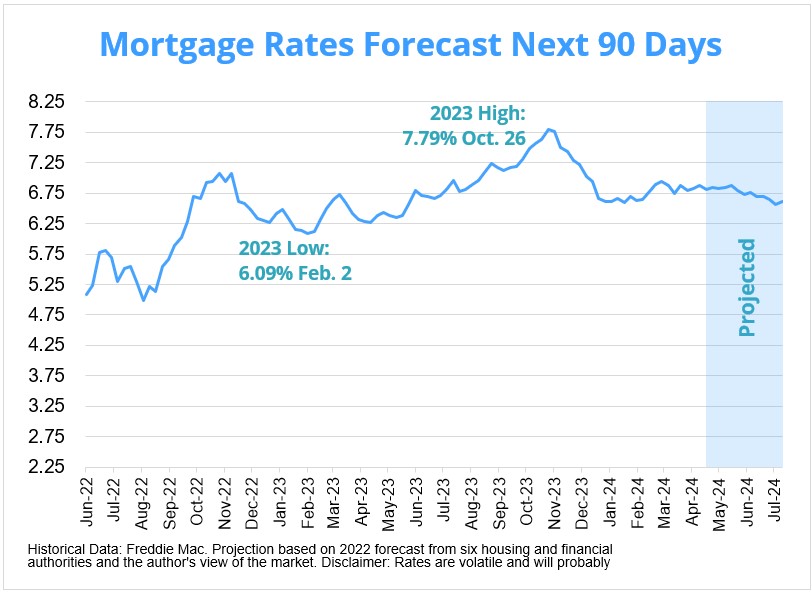

The Bank of Canada is widely expected to raise its key interest rate by a quarter-point to 5.00% on Wednesday, July 12th. This will mark the second consecutive interest rate hike by the Bank, following a similar move in June.

The decision comes as the Bank grapples with persistently high inflation. Canada's annual inflation rate reached 7.7% in May, the highest level since 1983. The Bank's target inflation rate is 2.0%.

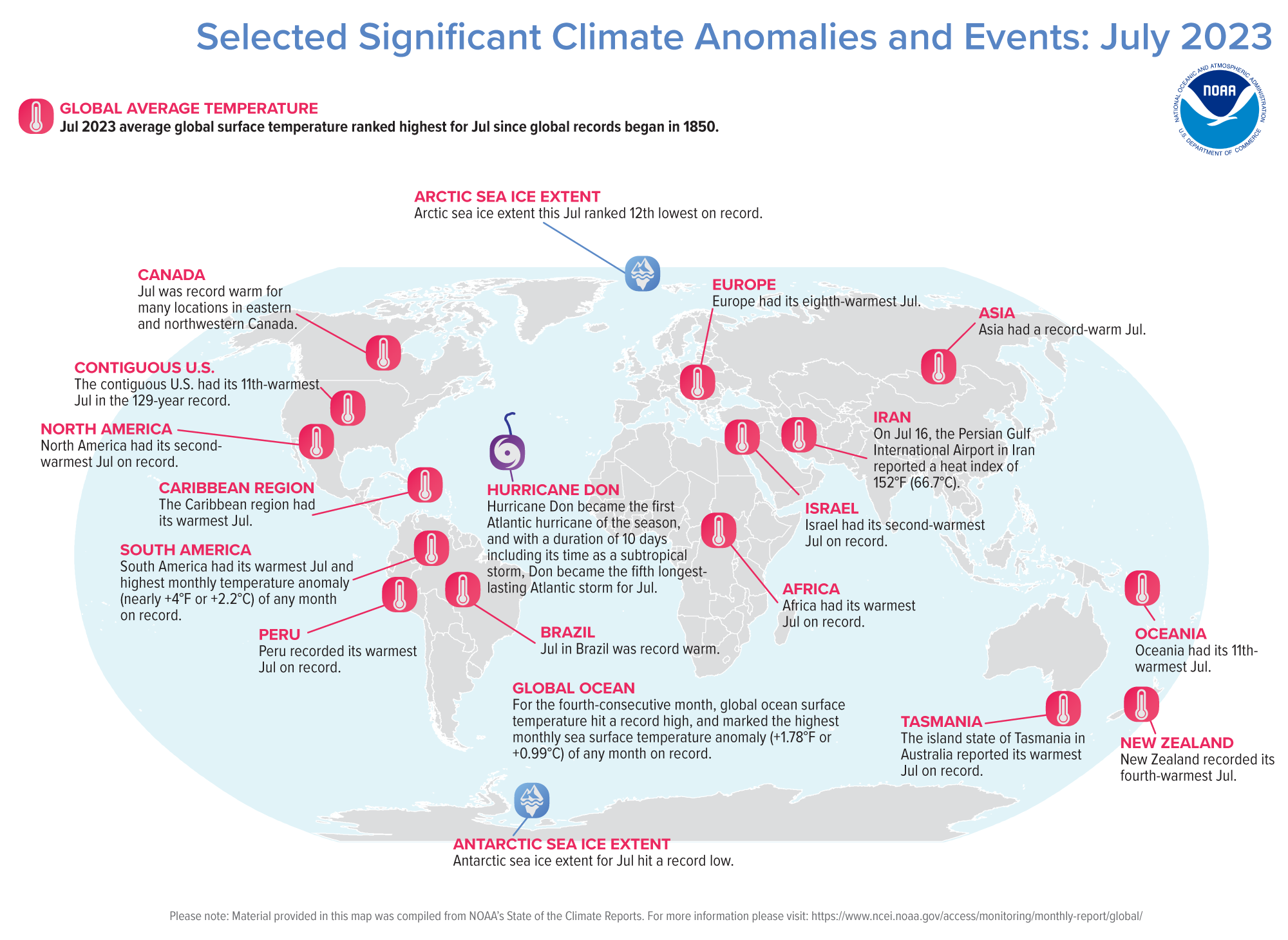

However, some economists have questioned the Bank's aggressive rate hike approach, arguing that it could lead to an unnecessary economic slowdown. They point to the fact that inflation is largely being driven by global factors, such as supply chain disruptions and the war in Ukraine.

The Bank has acknowledged the risks associated with raising interest rates too quickly. However, it has also argued that it needs to act to bring inflation under control. The Bank has said that it will continue to monitor economic data and adjust its policy stance as needed.

The upcoming interest rate decision will be closely watched by economists and financial markets. It could have a significant impact on the Canadian economy and household finances.

Komentar